Bybit Pay Later uses the equal principal and interest repayment structure, meaning your total monthly repayment amount stays the same throughout the installment period. However, the portion of principal and interest in each repayment varies. This article explains the full calculation process step by step.

Interest and Installment Amount

The system interest rate is updated hourly. Once your installment plan is confirmed, the rate is locked and remains fixed for the duration of the plan. Interest is charged based on the actual borrowing days for each installment.

Key Formulas

|

Item |

Formula |

|

Daily interest rate (r) |

r = R ÷ 365, where R is the annual interest rate. |

|

Borrowing days (D) |

The number of borrowing days in each installment. 1st installment: D₁ = (End date of month − Installment effective date) + 1 Subsequent installments: Dx = Days in that month |

|

Cumulative borrowing days (T) |

Total borrowing days up to a given installment, used to calculate the discount factor. 1st installment: T₁ = D₁ |

|

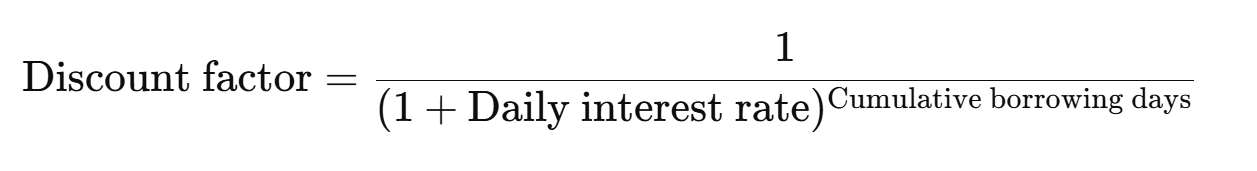

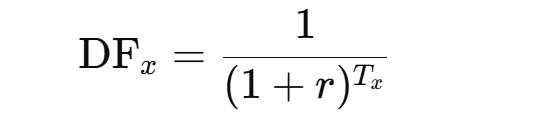

Discount factor (DF) |

Represents the present value of each future installment and is used to determine the installment amount.

|

|

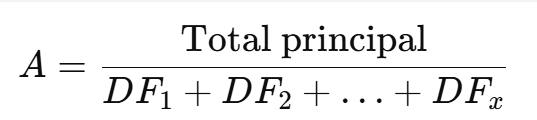

Installment amount (A) |

The equal repayment amount for each installment.

|

|

Principal repaid per installment |

The portion of each installment that goes toward repaying the principal. Principal repaid = Installment amount − Interest For the final installment: Principal repaid = Remaining principal |

|

Remaining principal |

The amount of outstanding principal after each installment. Interest for the next installment is calculated based on the remaining principal, rather than the total principal. 1st installment: Remaining principal = Total principal Remaining principal = Total principal − Principal repaid₁ Remaining principal = Total principal − Principal repaid₁ − Principal repaid₂ … and so on. |

|

Interest per installment |

Interest = Remaining principal × r × Borrowing days |

Example

Suppose Alice borrows 1,000 USDT at an annual interest rate of 20% on Oct 27, using a 3-month installment plan. Let's walk through the calculations step by step.

Step 1: Define the basic parameters.

-

Total principal: 1,000 USDT

-

Annual interest rate (R): 20%

-

Daily interest rate (r): 20% ÷ 365 ≈ 0.000547945

-

Duration: 3 months

|

Installment |

Period |

Borrowing days (Dₓ) |

Cumulative days (Tₓ) |

|

1st |

Oct 27 ‒ Oct 31 |

(31 − 27) + 1 = 5 |

5 |

|

2nd |

Nov |

30 |

5 + 30 = 35 |

|

3rd |

Dec |

31 |

5 + 30 + 31 = 66 |

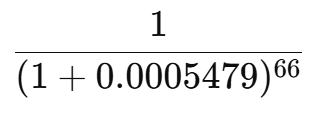

Step 2: Calculate the discount factor for each installment.

Where,

-

DFₓ is the discount factor for installment x.

-

r is the daily interest rate.

-

Tₓ is the cumulative borrowing days for installment x.

|

Installment |

Cumulative days (Tₓ) |

Formula |

DFₓ |

|

1st |

5 |

|

0.99727 |

|

2nd |

35 |

|

0.98086 |

|

3rd |

66 |

|

0.96405 |

Step 3: Calculate the installment amount (A).

A = Total principal ÷ (DF₁ + DF₂ + … + DFₓ)

= 1,000 ÷ (0.99727 + 0.98086 + 0.96405) ≈ 339.82 USDT

The monthly installment amount is 339.82 USDT.

Step 4: Calculate the principal repaid and interest for each installment.

Now that we know the monthly repayment amount is 339.82 USDT, the interest for each installment depends on the remaining principal and the number of borrowing days in that period.

|

Installment |

Dₓ |

Interest (USDT) |

Principal repaid (USDT) |

Remaining principal (USDT) |

|

1st |

5 |

1,000 × 0.000547945 × 5 = 2.74 |

339.82 − 2.74 = 337.08 |

1,000 − 337.08 = 662.92 |

|

2nd |

30 |

662.92 × 0.000547945 × 30 = 10.90 |

339.82 − 10.90 = 328.92 |

662.92 − 328.92 = 334.00 |

|

3rd |

31 |

334.00 × 0.000547945 × 31 = 5.67 |

339.82 − 5.67 = 334.15 USDT* |

0 |

*Note: The actual principal repaid in the last installment equals the remaining principal of 334.00 USDT.

Step 5: The final installment summary is as follows.

|

Installment |

Borrowing days |

Installment amount (USDT) |

Interest (USDT) |

Principal repaid (USDT) |

Remaining principal (USDT) |

|

1st |

5 |

339.82 |

2.74 |

337.08 |

662.92 |

|

2nd |

30 |

339.82 |

10.90 |

328.92 |

334.00 |

|

3rd |

31 |

339.82 |

5.67 |

334.15 |

0 |

Repayment

The repayment amount for each installment will be shown on your monthly statement, generated on the first day of each month. Since auto-repayment is not available, repayments must be made manually. The due date is the 8th of each month. For detailed repayment steps, please refer to this article for Bybit Card and this article for Bybit Pay.

A 72-hour grace period applies after the due date. During this period, penalty interest is charged hourly at three times (3×) the regular rate. This continues to accrue until full repayment is made or until collateral is liquidated.

Penalty interest formula:

-

Penalty interest = Outstanding principal × Hourly interest rate × 3 × Overdue hours

-

Hourly interest rate = Annual interest rate ÷ 365 ÷ 24

If you make a partial repayment, the payment will be applied first to the interest due (including any penalty interest), and any remaining amount will be used to repay the principal:

Outstanding principal = Principal for the installment − Any principal repaid

If the outstanding amount remains unpaid after the 72-hour grace period, your collateral will be liquidated to cover the monthly repayment, accrued interest, and a 2% liquidation fee, calculated as:

Liquidation fee = (Outstanding principal + Regular interest + Penalty interest) × 2%

An overdue repayment for one month does not affect future installments. You can continue making future repayments as usual once the overdue amount is cleared.

Example

Let's continue with Alice's example to illustrate how repayments, penalty interests and liquidation work.

|

Installment |

Borrowing days |

Installment amount (USDT) |

Interest (USDT) |

Principal repaid (USDT) |

Remaining principal (USDT) |

|

1st |

5 |

339.82 |

2.74 |

337.08 |

662.92 |

|

2nd |

30 |

339.82 |

10.90 |

328.92 |

334.00 |

|

3rd |

31 |

339.82 |

5.67 |

334.15 |

0 |

Scenario 1: Full installment overdue

Alice fails to repay her 2nd installment on time, due on Dec 8.

a. Repayment made within the grace period

If Alice repays 50 hours after the due date (Dec 8), penalty interest will apply for that period.

-

Penalty interest = 328.92 × (20% ÷ 365 ÷ 24) × 3 × 50 ≈ 1.126439 USDT

-

Total repayment = Installment amount + Penalty interest = 339.82 + 1.126439 = 340.946439 USDT

b. No repayment made within the grace period

If Alice doesn't repay within the 72-hour grace period, liquidation will be triggered.

-

Penalty interest = 328.92 × (20% ÷ 365 ÷ 24) × 3 × 72 ≈ 1.622072 USDT

-

Liquidation fee = (328.92 + 10.90 + 1.622072) × 2% ≈ 6.828842 USDT

Scenario 2: Partial installment overdue

Alice makes a partial repayment of 100 USDT on Dec 3 for her 2nd installment, which is due on Dec 8. The repayment is applied first to the interest, and the remaining amount goes toward the principal.

a. Outstanding amount repaid within the grace period

If Alice repays the outstanding amount 50 hours after the due date (Dec 8):

-

Outstanding principal = 328.92 − (100 − 10.90) = 239.82 USDT

-

Penalty interest = 239.82 × (20% ÷ 365 ÷ 24) × 3 × 50 ≈ 0.821302 USDT

-

Total repayment = Installment amount + Penalty interest = 339.82 + 0.821302 = 340.641302 USDT

b. Outstanding amount not repaid within the grace period

If Alice doesn't repay the outstanding amount within the grace period, liquidation will be triggered.

-

Outstanding principal = 328.92 − (100 − 10.90) = 239.82 USDT

-

Penalty interest = 239.82 × (20% ÷ 365 ÷ 24) × 3 × 72 ≈ 1.182674 USDT

-

Liquidation fee = (239.82 + 10.90 + 1.182674) × 2% ≈ 5.038054 USDT

Note: All figures above are for illustrative purposes only. Please refer to the product page for your exact repayment details.